r&d tax credit calculator 2019

RD tax credits generated in 2017 can be used to offset payroll taxes come mid-2018 and RD tax credits generated in 2018 can be used to reduce payroll taxes in 2019. Home RD Tax Credits Calculator.

A Simple Guide To The R D Tax Credit Bench Accounting

Ad All Major Tax Situations Are Supported for Free.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

. Let our experts research and provide information that you need to understand how this credit can genuinely benefit your business. Free RD Tax Calculator. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

Rd report for Based on the information you provided it looks like we could help you claim back up to for. Use Titan Armors calculators to estimate your state and federal RD tax credit benefits or to see if you can offset your payroll tax. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

Introduced in Senate 07232019 Research and Development Tax Credit Expansion Act of 2019. A 15 minute. If you would like a detailed analysis of the potential benefits or.

What expenses qualify for the research. Risk free no obligation education call where we explain the RD tax credit in detail. This is only an approximation based on a variety of assumptions and should be treated as such.

Easy Fast Secure. Calculate how much RD tax relief your business could claim back. This bill modifies the refundable research tax credit for new and small businesses to 1 increase the limit on refundability to 500000 with an adjustment for inflation.

We will show you how. And so the RD tax credit has been revised to give more instant gratification. Start Your Tax Return Today.

The results from our RD Tax Credit Calculator are only estimated figures and actual numbers will vary depending on the specific circumstances of the business. Estimate RD tax relief for your business. The RD tax credit is now permanent and for the first time ever small businesses and start-ups can take advantage of this lucrative tax credit.

Across all sectors the average amount reclaimed for our clients is 50000. Guidance on this can be found on our Which RD scheme is right for my company page. For startups applying the credit against payroll taxes is a valuable non-dilutive funding opportunity.

Calculate RD tax relief in under 3 minutes. And we do not want to stop here without helping you. What is the RD tax credit worth.

Average calculated RD claim is 56000. Free means free and IRS e-file is included. Max refund is guaranteed and 100 accurate.

RD Tax Credit Calculator. 2 allow refundable amounts to cover all payroll taxes paid by such businesses. Tax credits calculator - GOVUK.

This calculator has been developed utilizing data from a variety of studies conducted in the industries listed. Calculate Your RD Tax Credit. For most companies the credit is worth 7-10 of qualified research expenses.

Estimate your tax savings using our quick simple RD Payroll Tax Credit Calculator then contact us using the form above. Revenue guidelines update 2019 In March 2019 Revenue published updated guidelines for the RD tax credit Tax and Duty Manual Part 29-02-03 superseding the April. This is a dollar-for-dollar credit against taxes owed.

One of our RD experts will contact you. RD Payroll Tax Credit Calculator. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

How to calculate the RD tax credit using the traditional method. Just follow the simple steps below. First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same period.

Its easy and free. This call is required in order for us to determine whether you qualify. Select whether the company is profitable or loss making.

Plus it carries forward 20 years. Select either an SME or Large company. The Kruze Consulting RD Tax Credit Calculator is designed to estimate your RD tax credit using.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Enter Current Year Total Wages Average Annual Growth over prior 3 years Projected net federal credit. The RD tax credit calculation can be done under the regular research credit method or the alternative simplified credit.

In 2021 alone alliantgroup delivered over 23 billion in credits and incentives to over 14000 businesses. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in. Home RD Tax Credits Calculator.

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

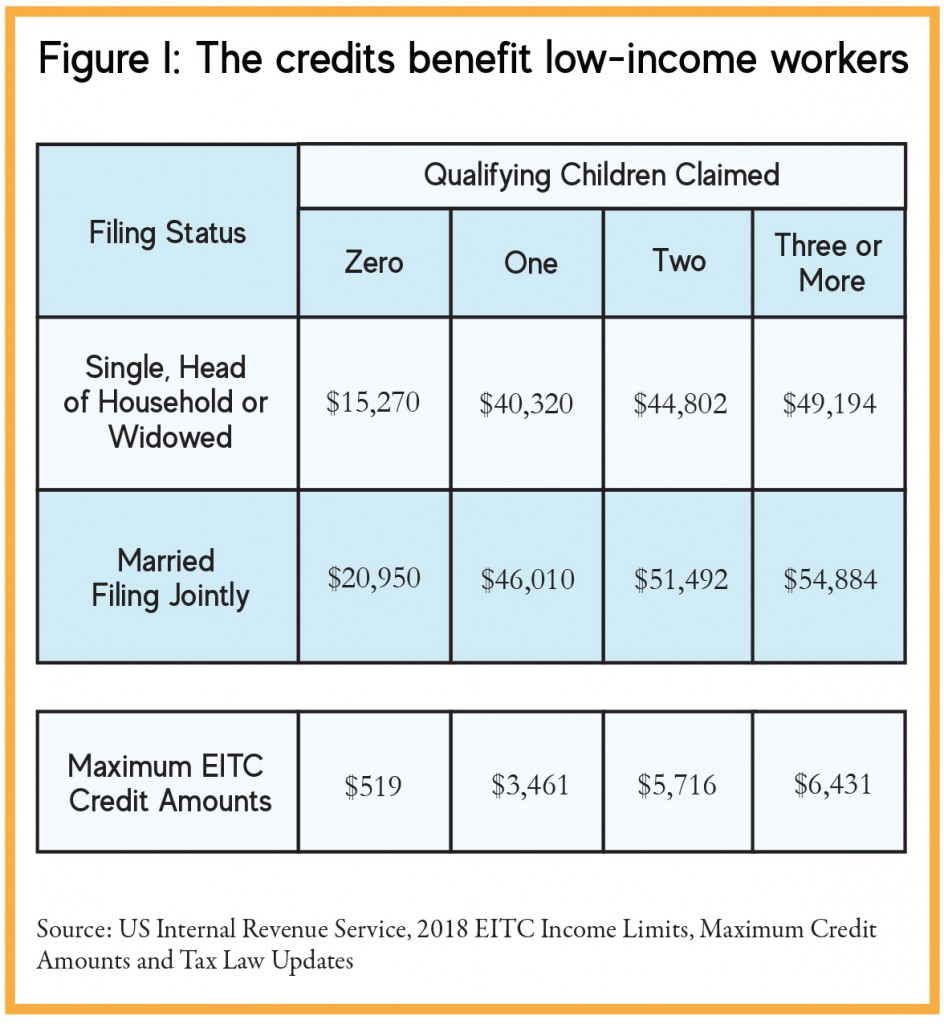

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

The Advantages Of Being An Independent Contractor Bryan Patrice Investment Tools Finance Debt Building Credit Score

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

How The Tcja Tax Law Affects Your Personal Finances

R D Tax Credit Calculation Methods Adp

Download Wedding Guest List Excel Template Exceldatapro

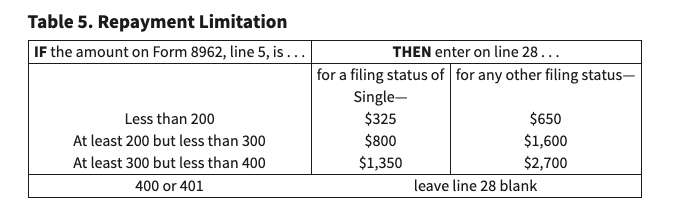

Advanced Tax Credit Repayment Limits

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Business Woman Using Calculator And Laptop For Do Math Finance On Wooden Desk In Office And Bookkeeping Services Accounting Services Digital Marketing Services

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

What S Your Credit Score Federal Credit Union Credit Score Student Login

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow